The regulatory technology (RegTech) industry is at a tipping point right now. Over the past decade, the industry has grown rapidly on the back of the ever-increasing regulatory burden and the cost of maintaining compliance. However, with the coronavirus pandemic creating a whole new set of challenges for compliance teams, demand for RegTech solutions has risen to the next level. Financial institutions have realized that the only way to handle compliance efficiently today is to embrace technology.

To get a better understanding of how the pandemic has impacted RegTech firms, Clausematch recently conducted its first ‘Voice of RegTech’ survey between May 2020 and May 2021. Below are the findings from our survey. To view the full report, click here.

1.) There is an increase in demand for innovative RegTech solutions

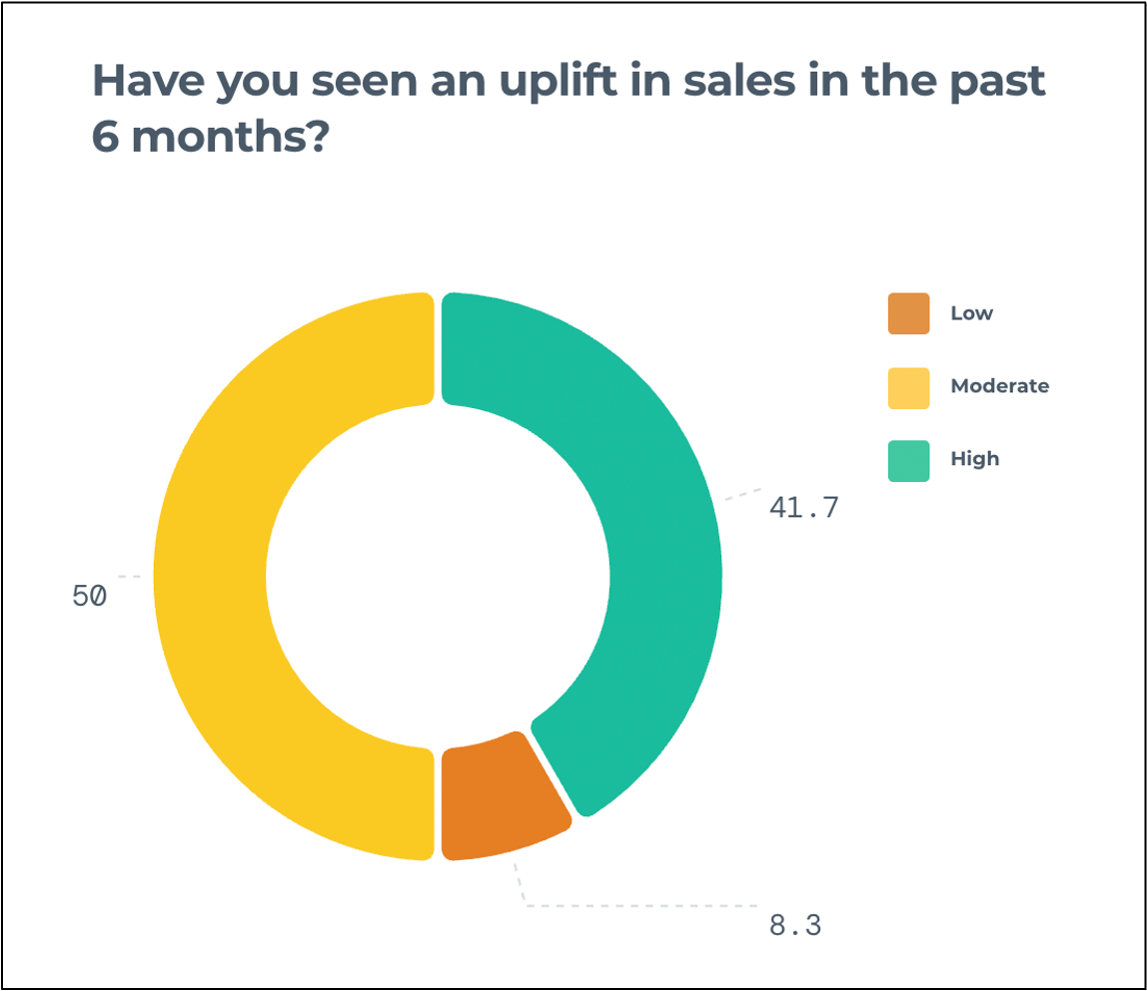

Changes to working practices throughout Covid-19 have increased demand for innovative RegTech solutions that can enhance oversight, improve collaboration, and boost overall efficiency and this is redirected in sales trends across the industry. Of the RegTech firms that participated in the Voice of RegTech survey, 42% said that they had experienced a ‘high’ uplift in sales over the last six months. Meanwhile, 50% of firms said that they had seen a ‘moderate’ increase in sales over the last six months.

2.) The sales cycles have somewhat shortened

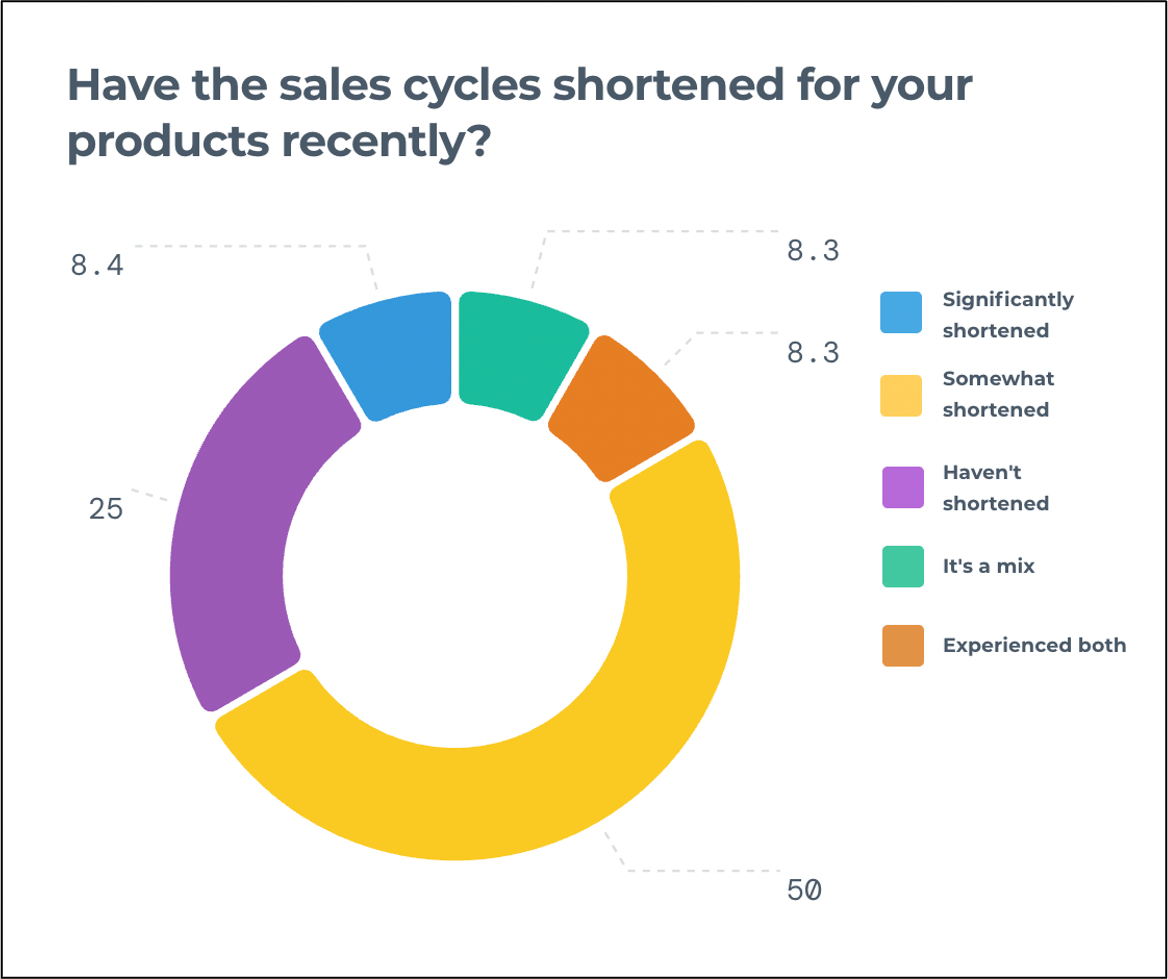

In relation to sales cycles, the pandemic appears to have shortened them to a degree. 50% of survey respondents said that sales cycles had ‘somewhat shortened’ recently while 8% reported that sales cycles had ‘significantly’ shortened recently. This is a positive development for the industry. Traditionally, sales cycles for RegTech firms have been quite lengthy. The RegTech report by the City of London and RegTech Associates lists long procurement cycles as one of the top barriers to adoption.

3.) There is an increase in remote compliance

Survey participants reported several key compliance trends throughout the pandemic, with the most dominant trend being the increase in remote compliance. This is no surprise as the vast majority of financial services firms were forced to shift to a work-from-home model during the pandemic. This new style of working has opened a whole new set of risks for compliance teams. For example, remote working has led to employees using unmonitored communication apps such as WhatsApp to handle sensitive information. In October last year, the UK’s Financial Conduct Authority (FCA) warned banks that they must provide the same standard of surveillance of staff working from home as they would in an office environment.

Survey participants also reported that the pandemic has resulted in a rise in virtual know-your-customer (KYC) checks and boosted demand for holistic RegTech solutions that bring everything together on one platform.

"We expect firms to have updated their policies, refreshed their training and put in place rigorous oversight reflecting the new environment - particularly regarding the risk of use of privately-owned devices.” -Julia Hoggart, FCA’s Director of Market Oversight

4.) New business from cloud-based products is coming from banks

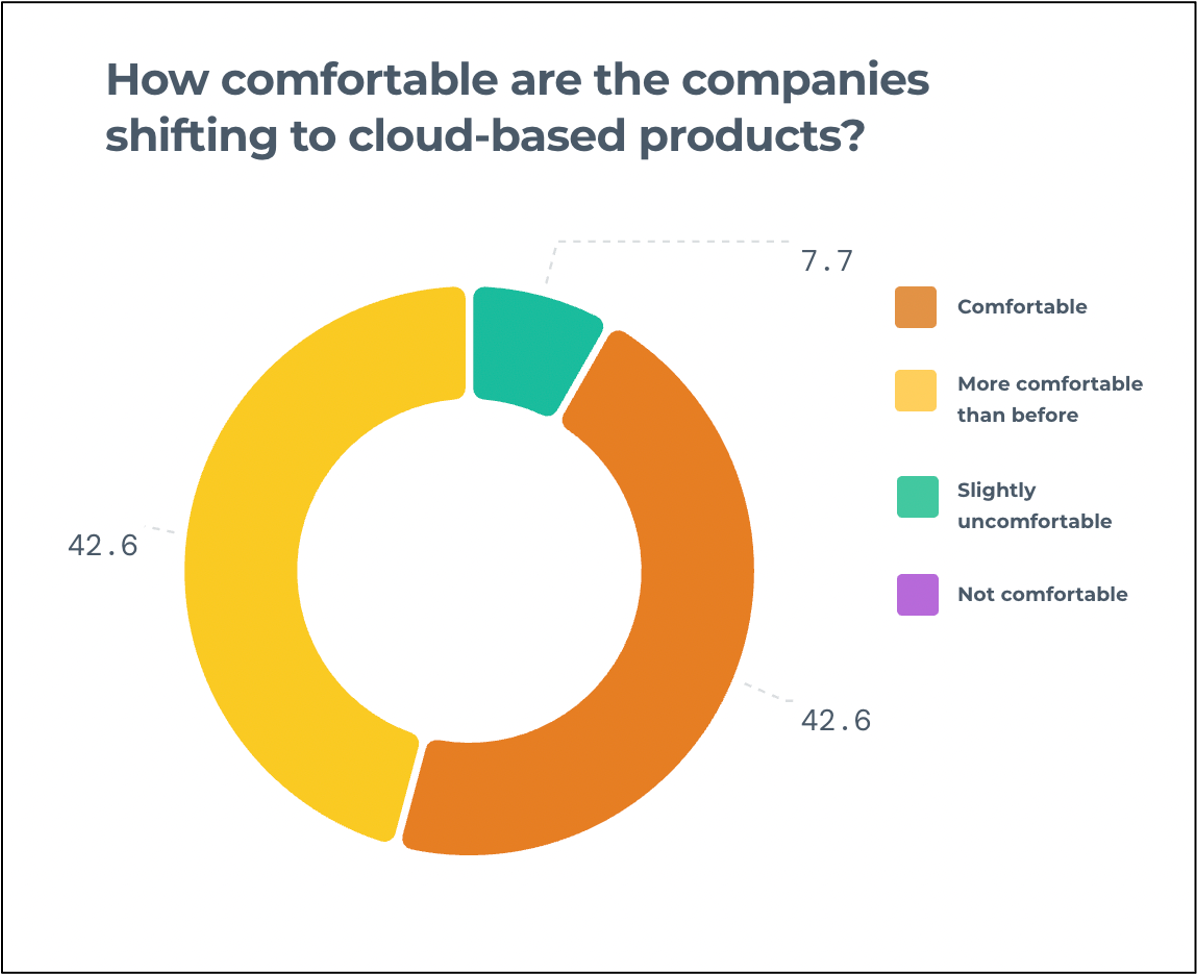

Financial institutions have generally been slow to embrace cloud technology in the past. There are a few reasons for this. One is fear in relation to potential cybersecurity failings of cloud technology. Another is cloud service providers’ compliance with the complex regulatory framework that governs the financial industry. Attitudes towards cloud technology within the financial services industry appear to be changing, however. 46% of participants in our survey reported that their clients were comfortable with cloud-based products while 46% said that their clients were ‘more comfortable’ with cloud technology than they were in the past.

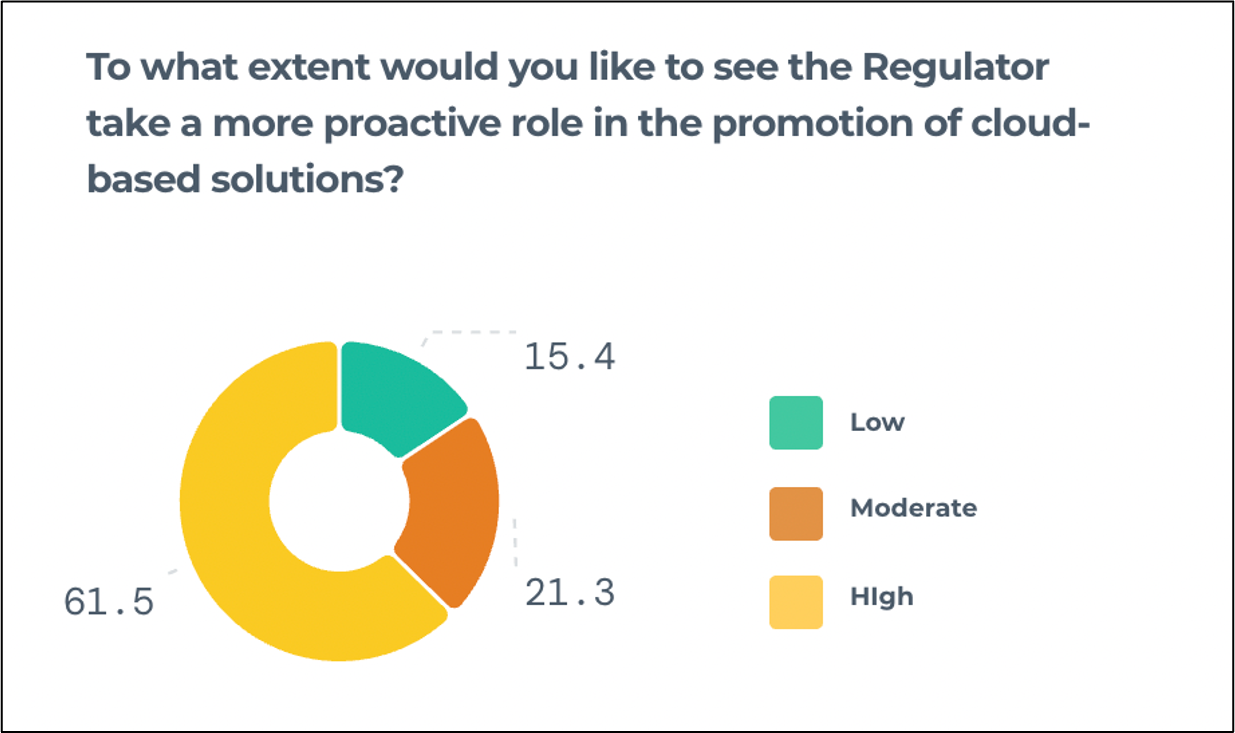

5.) Vendors want regulators to take a more proactive role in the promotion of cloud-based solutions

One issue that has come up a lot recently is the role of regulators in the adoption of RegTech solutions. Many vendors believe that regulators should actively promote the use of RegTech. The study from the City of London and RegTech Associates, for example, found that 69% of vendors wanted supervisors to encourage regulated firms to increase their adoption of RegTech as part of the supervisory process. Another survey from RegTech firm eflow found that 64% of vendors wanted regulators to promote the technology.

Our Voice of RegTech survey had similar findings. Around 85% of participants said that they were keen for regulators to take a more proactive role in the promotion of innovative RegTech solutions.

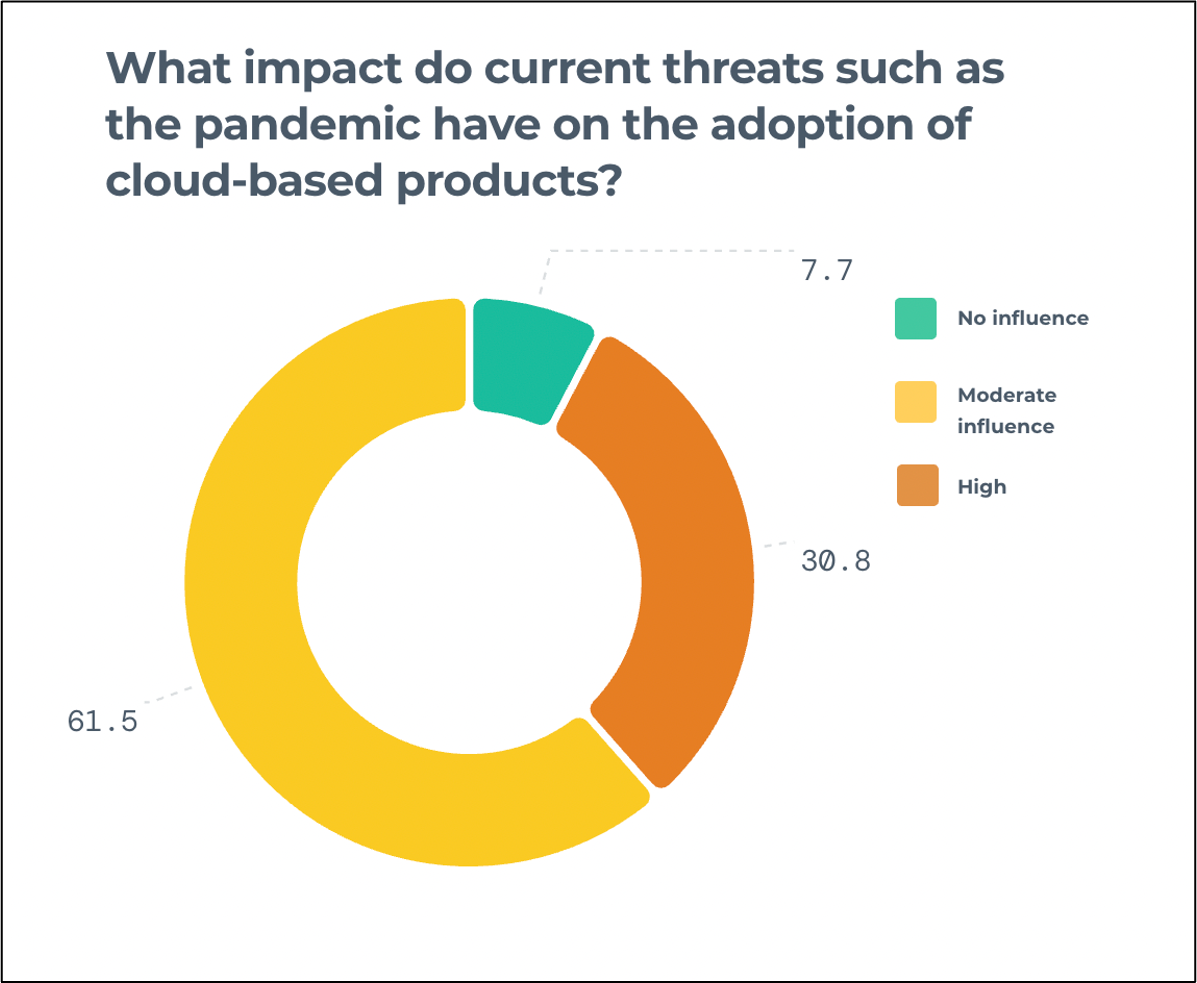

These are just a few of the key takeaways from the Voice of RegTech report. The biggest takeaway is that the pandemic has increased the demand for RegTech solutions within the financial services industry. With Covid-19 creating a range of new challenges for compliance teams, financial institutions have turned to technology to increase efficiency, facilitate communication for distributed teams and ease the compliance burden.

For more information, check out the findings from the Voice of RegTech report.