The year 2020 was one for the history books. The pandemic put a stop to the global population's plans, forcing people to work from home and giving them time to focus on their loved ones. The safety of vulnerable people in society became a priority. This, however, did not slow down the efforts of the DOJ and SEC, in their quest to ensure that organizations were abiding to the increasingly pervasive standards for corporate conduct.

How did organizations perform from a compliance standpoint in 2020 vs. 2008? We compiled a breakdown of conduct fines since the financial crisis of 2008.

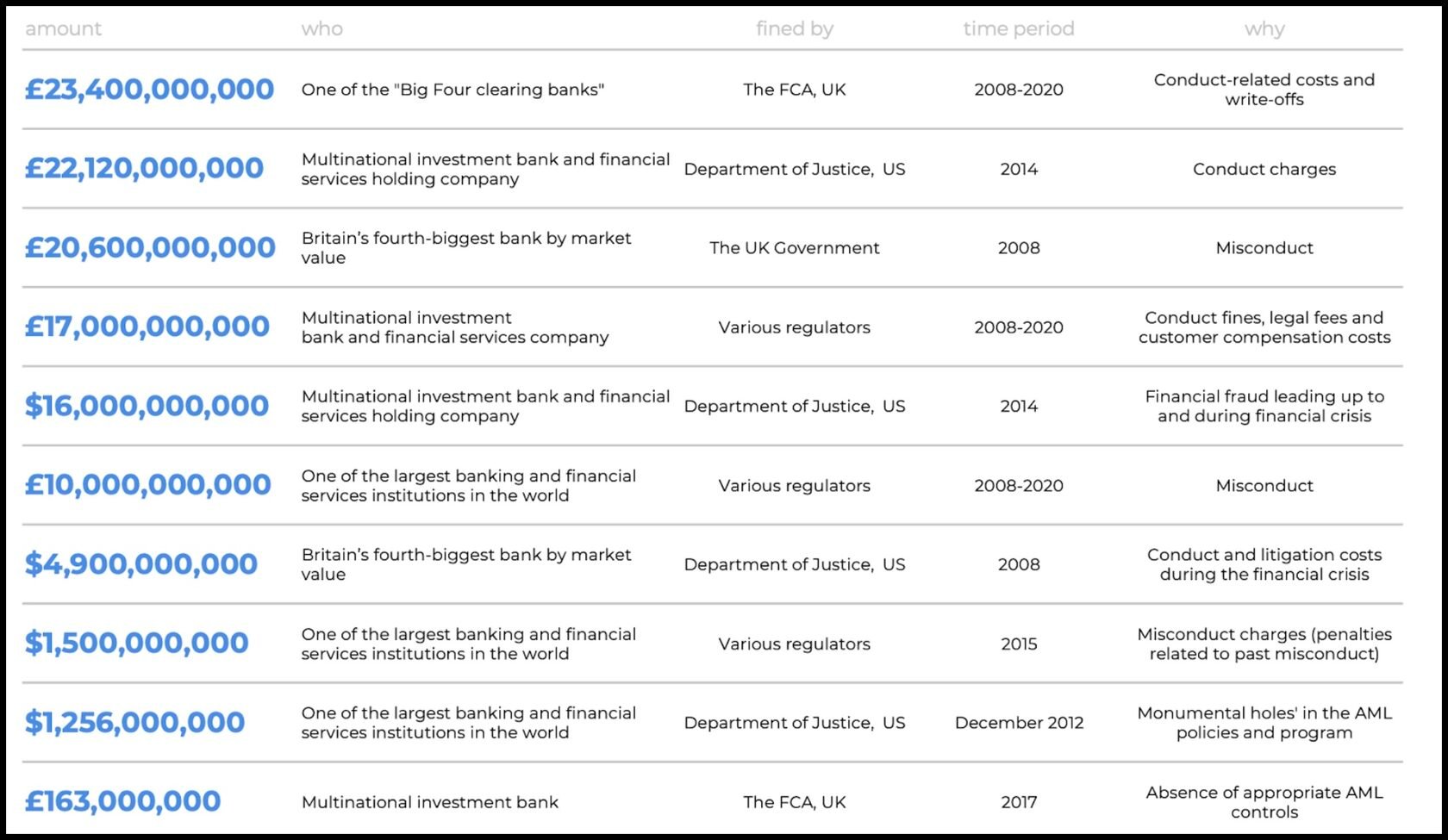

Top Conduct Fines from 2008-2019

According to Thomson Reuters, regulators in the United States and Europe have imposed $342 billion of fines on banks since 2008-2009 for misconduct. Below we selected the most impactful fines that were caused by misconduct and the absence of proper controls and policies. Some of these fines are so significant that they in turn led to a financial crisis.

As a result of these historic fines, financial services companies have been forced to make significant new investments in their compliance, controls and oversight – however, with new cases often in the news, it appears that much more effort remains to be done.

"We see regulators are starting to pay closer attention to behavior, ethics, and conduct in organizations. That's why it's time for firms to start implementing technology with more cultural emphasis. In some cases, when regulators started applying machine learning to transaction data, they started uncovering fraud before banks. Now, regulators want to see banks applying technology in their compliance programs in order to make them work well, managed dynamically in line with regulations and get increased engagement with compliance content from employees."

— Evgeny Likhoded, CEO and founder at Clausematch

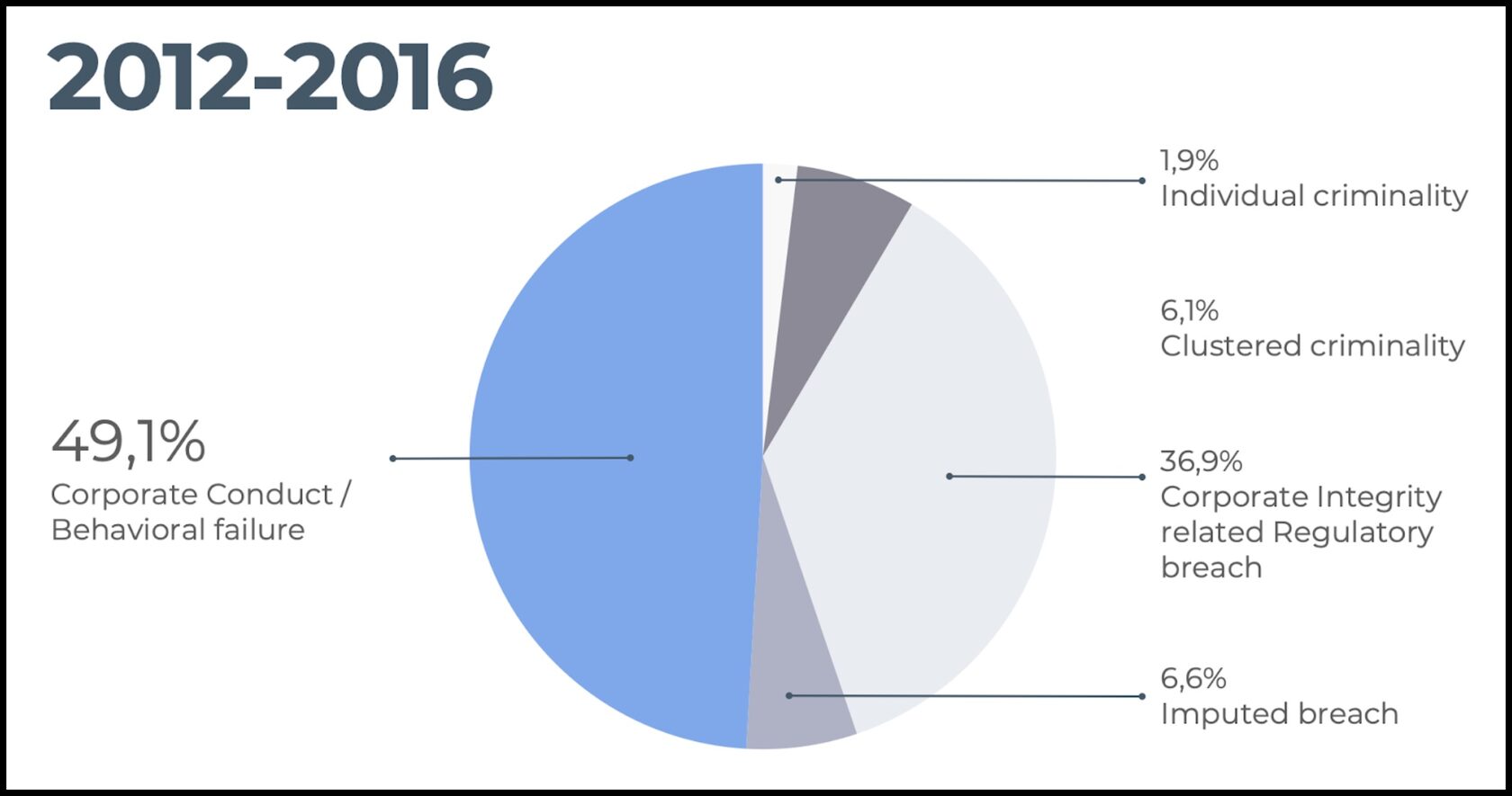

Breakdown in Conduct Fines from 2012-2016

From 2012-2016, the world's top 20 banks were hit with conduct charges, an increase of almost a third compared to the same period from 2008-2012. Almost 50% of these charges were for corporate conduct/behavioral failures.

2020 Conduct Fines

In 2020, there was an increase in fines for conduct in financial services all over the globe. In the United States alone, Q4 saw an influx of corruption cases. A U.S. SMB banking corporation was fined $80 million dollars for corruption, while one of the Big Four Banks of the United States, Wells Fargo, settled the largest fine for conduct fines issued to date in the U.S. The bank had to pay out $3 billion for fraudulent account openings and poor treatment of customers. These wrongdoings resulted in massive reputational damage and loss of trust in the bank and its practices. Wells Fargo has been trying to rebuild its reputation ever since, and to their credit, they have been very transparent about this loss of trust with their customers, and they've been actively and openly trying to rebuild it.

"We have seen aggressive enforcement coupled with demands for better compliance programs and a commitment to ethics. Corporate compliance is going through its biggest revolution. This shift to embedded compliance and a change in culture is happening and will be crucial for financial institutions in the future."

— Michael Volkov, CEO and owner of The Volkov Law Group, LLC

With reputation being more influential than ever and the internet readily offering up information on institutional failures to anyone who looks for it, companies need to ensure all is above board so they keep their reputation intact. By looking at the mistakes made last year by these high profile companies, organizations can ensure that they don't make the same mistakes in the future.

To learn how to protect your organization and meet compliance obligations, click here or contact Clausematch today.